Accurate tax filing and optimizing tax savings are frequent obstacles faced by freelancers and business owners. Form 1099-NEC filing is a crucial component of freelancers’ tax compliance. This post will explain Form 1099-NEC, explain how self-employed tax calculators can be used by freelancers to determine their estimated tax burden, and explain why it will be crucial for freelancers to file quarterly taxes in 2023.

What is a 1099 Form?

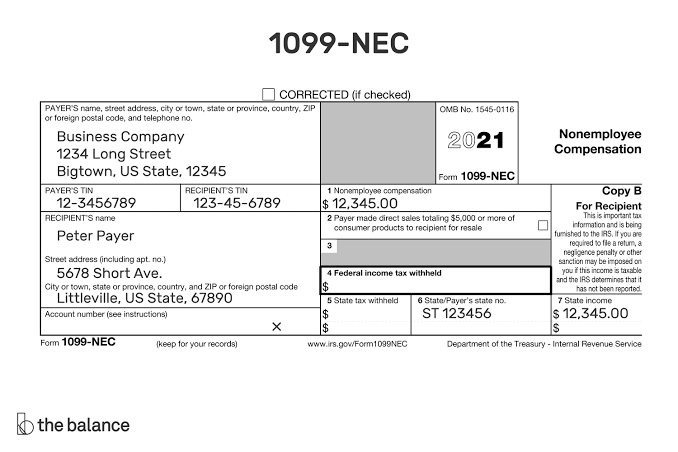

Reporting of nonemployee compensation to freelancers, independent contractors, and other self-employed individuals is done using Form 1099-NEC. You might receive a Form 1099-NEC from a client or source of income if, as a freelancer, you made more than $600 from that source or client during the tax year. This form is a crucial component of your tax filing requirements as a freelancer since it is used to record your income to the IRS.

It’s crucial to remember that, as a freelancer, you are regarded as self-employed and must pay self-employment taxes on your earnings. This covers the employer and employee shares of Medicare and Social Security taxes, which can total a sizeable portion of your income. You may estimate your tax burden and make quarterly tax payments 2023 by using a self-employment tax calculator.

Calculator for Self-Employment Tax

Freelancers can estimate their tax due and make payment plans with the help of a self-employment tax calculator. You can determine an estimate of your annual self-employment tax liability by putting in your income, expenses, and other pertinent data in the calculator. By doing this, you may better plan your tax payments and minimize any unpleasant surprises when it comes time to submit your returns.

A self-employment tax calculator will assist you in determining any credits and deductions that you could be qualified for as a freelancer in addition to calculating your tax burden. By doing this, you can lower your overall tax burden and optimize your tax savings. You can prevent overpaying taxes and preserve more of your hard-earned money in your pocket by utilizing all of the tax benefits that are available.

2023 Quarterly Tax Remittances

Making quarterly tax payments is crucial for independent contractors and self-employed people to maintain IRS compliance and prevent underpayment penalties. The following dates apply to the quarterly tax payments due in 2023:

– June 15, 2023; September 15, 2023; April 15, 2023; January 15, 2024

You can spread out your tax liability and prevent a hefty tax bill at the end of the year by paying your taxes quarterly throughout the year. This might assist you in better budgeting for your tax payments and managing your financial flow. You can use this information to calculate how much you need to pay each quarter to keep up with your tax responsibilities if you estimate your tax burden using a self-employment tax calculator.

In conclusion, for independent contractors and self-employed people, submitting Form 1099-NEC is a crucial component of tax compliance. In 2023, you may remain on top of your tax duties and prevent penalties for underpayment of taxes by estimating your tax burden using a self-employment tax calculator and paying taxes quarterly. You may optimize your tax savings and retain a larger portion of your hard-earned money in your pocket by being proactive with your taxes.

Stay in touch to get more updates & news on Hint Insider!